Renewables4U recognizes that the past few years have been full of uncertainty, from pandemics to lockdowns, and now an increase in living costs and interest rates. Very few businesses have idle cash in the bank without a well-thought-out investment plan. Typically, businesses consider their power costs as operational expenses and allocate a monthly budget to cover them.

When interest rates rise, consumers and businesses alike tend to adjust and reduce their spending to ensure they have sufficient cash to cover their expenses. During such times, considering a renewable energy system for your business should be a top priority. Not only is it beneficial for the environment and aligns with the ‘Net Zero’ target of 2050, but with a properly structured payment plan, it could lead to a positive cash flow outcome. This means that the total cost of your renewable energy system repayment, plus the remaining power bill, would be less than your current power expenses without a renewable energy system. Moreover, once you complete the repayments, you will enjoy significant savings compared to doing nothing.

Some businesses plan to save up and pay outright for a renewable energy solution in the future. While this approach seems reasonable, it’s essential to consider that, during that waiting period, material costs and power expenses may increase, government incentives might decrease, and obtaining approval for the system may take over 18 months from application submission. Unfortunately, during this waiting period, you miss out on the savings the system could generate, and you continue to rely on power from the grid, which may not be environmentally friendly.

As our grandmothers used to tell us, where there’s a will, there’s a way. The question is, do you have the determination to explore a cleaner and greener renewable energy future today?

IMPORTANT NOTE: None of this information should be considered as financial advice. Renewables4U are not accountants or tax advisors. We are simply presenting some of the options available to businesses. Please consult with a professional accountant or tax advisor before making any decisions.

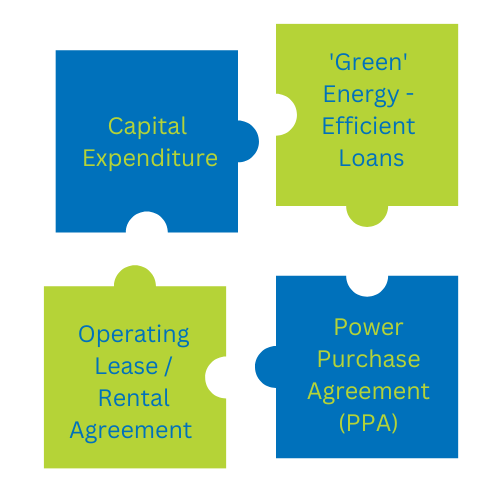

What’s the missing piece to your puzzle ?

Paying in CASH for your Renewable Energy Solution

When purchasing a renewable energy system for a business in Australia, cash can have both advantages and disadvantages. Businesses often have multiple projects to fund and limited working capital. As generating their own energy is not typically a core business activity, it may become a challenge to prioritize investment in a renewable energy solution.

On the positive side, cash transactions have benefits. They eliminate the need for debt, avoiding interest payments and reducing financial risk. Moreover, paying in cash provides a sense of ownership without additional obligations. As the saying goes, cash is always king.

However, cash payments also come with drawbacks. The substantial upfront cost of a renewable energy system can strain a business’s immediate cash flow, potentially hindering other investments. Additionally, using cash may limit financial flexibility and impede the ability to access additional benefits such as tax incentives or financing options. Ultimately, the decision to pay in cash should be carefully considered, taking into account the specific financial situation and long-term goals of the business.

Using a ‘GREEN’ loan for your Renewable Energy Solution

Utilizing a green loan from a bank to invest in a renewable energy solution for a business in Australia comes with its advantages and disadvantages. The Clean Energy Finance Corporation (CEFC) has played a significant role in providing over AU $1.8 billion in discounted green energy efficient loans, facilitating the installation of more than 46,000 renewable energy solutions. These loans are accessible from major banks in Australia and can cover expenses for heat pumps, LED lighting, demand management systems, and battery storage.

On the positive side, green loans offer lower interest rates than traditional loans, making them an appealing financing choice. Additionally, securing a green loan demonstrates a business’s commitment to sustainability, enhancing its reputation and attracting environmentally conscious customers.

However, there are downsides to consider. Green loans may have limitations on loan amounts, strict eligibility criteria, and longer approval procedures. Moreover, relying on a bank’s lending policies could limit access to a broader range of financing options. It’s crucial to carefully review the specific terms and conditions before opting for a green loan as a financing avenue for renewable energy projects.

To ensure the best decision, it’s always beneficial to compare a bank offering a CEFC-funded loan with your existing business learning options. This way, you can assess which option aligns better with your business’s financial needs and goals.

“Australia is targeting net zero emissions across our economy by 2050, an ambitious goal with far-reaching opportunities and benefits. We see our asset finance programs as an exciting way to back smaller-scale investments in a whole range of sustainability measures, accelerating our net zero transition while extending the sustainability benefits to businesses large and small.”

Ian Learmonth

Chief Executive Office at Clean Energy Finance Corporation (CEFC)

Further information on what the CEAF can offer assistance with can be found here.

Utilising a Power Purchase Agreement (PPA) to benefit from a Renewable Energy Solution

A Power Purchase Agreement (PPA) serves as a contract between an electricity generator and a consumer, commonly used by Australian businesses seeking renewable energy solutions. Under a PPA, the provider installs a renewable energy system at their cost, retains ownership of the system, and sells the produced energy back to the business at a predetermined price per unit. However, businesses should carefully consider both the pros and cons of PPAs before making a decision.

Pros:

- Cost Savings: PPAs offer fixed electricity prices, allowing businesses to lock in rates for an extended period. This shields them from volatile energy market prices and may lead to cost savings.

- Renewable Energy Access: PPAs enable businesses to directly procure power from renewable sources, helping them meet sustainability goals, enhance brand reputation, and attract environmentally-conscious customers.

- Long-term Security: PPAs provide long-term stability as they typically span 10-25 years. This certainty in energy supply enhances financial planning and reduces market uncertainties.

Cons:

- Contractual Obligations: Entering a long-term PPA may limit a business’s flexibility to switch to alternative energy sources or suppliers, restricting adaptability to future market developments.

- Financial Risk: If energy consumption decreases due to downsizing or other factors, businesses may still be obligated to pay for the contracted amount, leading to unnecessary financial burdens.

- Project Viability: PPAs are often associated with new renewable energy projects, which may carry risks like project delays, cost overruns, or failure to achieve expected performance targets, potentially impacting energy supply.

In conclusion, while PPAs offer cost savings, access to renewable energy, and long-term security for Australian businesses, they also entail current and future contractual obligations, financial risks, and concerns about project viability. Each business should evaluate its unique circumstances and objectives before entering into a PPA agreement.

Using an Operating Lease for your Renewable Energy Solution

An operating lease or rental agreement can have both advantages and disadvantages for an Australian business looking to acquire a renewable energy system. This financing solution is prevalent for two main reasons:

- It is an ‘income-producing’ asset.

- The 20-year depreciation ruling from the taxation department.

On the positive side, an operating lease allows businesses to avoid the significant upfront costs associated with purchasing solar panels or wind turbines, preserving their capital for other investments. The lease repayments are 100% tax deductible, just like the electricity bill. Although GST is charged on the repayments, it can be claimed back via quarterly BAS statements, making this operating lease the lowest finance cost option.

Since the asset is owned by the finance company, it doesn’t appear on the business’s balance sheet, providing more financial leverage to acquire other assets essential for business operations. Additionally, the agreement may include maintenance and servicing, easing the burden on the business.

However, the downside lies in the long-term costs, as the rental fees may end up higher than the eventual purchase price. Nevertheless, this trade-off is acceptable if the business lacks the initial capital to buy a renewable energy system outright.

In summary, an operating lease offers financial flexibility and tax benefits to Australian businesses seeking renewable energy solutions, though it may entail higher long-term costs compared to an outright purchase. Each business should carefully evaluate its financial situation and objectives before choosing an operating lease as a financing options.

Discover the perfect Renewable Energy System installation for you with the assistance of Renewables4U! Click on the link below, answer a few questions, and local endorsed companies will get in touch with you soon.